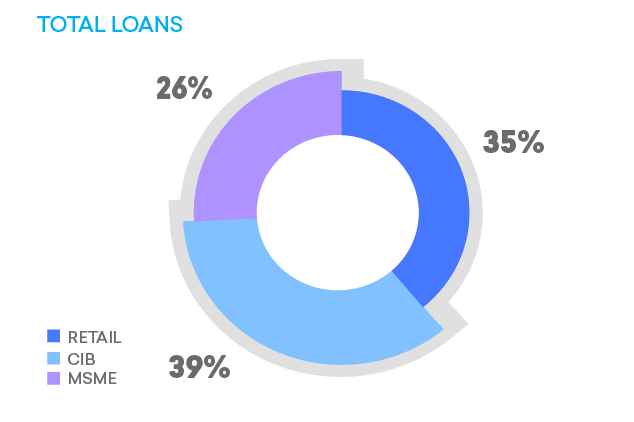

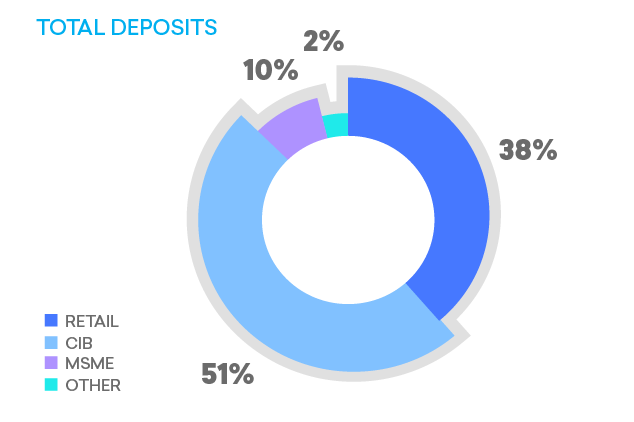

Our Georgian banking business is comprised of three major segments:

Retail, MSME and CIB

Loan and deposit portfolios as of 31 December 2023

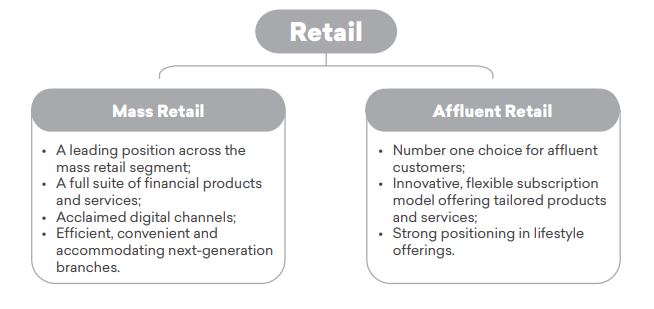

Retail Banking

We differentiate ourselves through the superior customer experience we deliver, the best-in-class digital channels we provide and the advanced data analytics tools and fully-fledged payments solutions we have developed.

FY 2023 highlights

-

38.1% retail loan market share1

-

36.0% retail deposit market share1

-

1.6 mln monthly active customers

-

61% NPS2

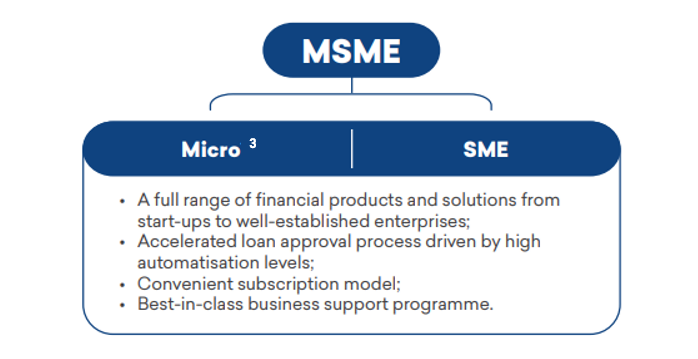

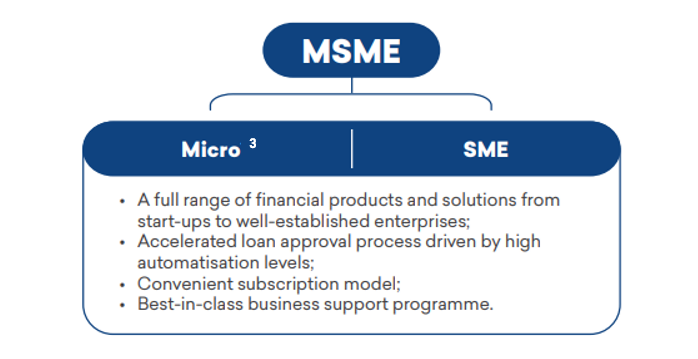

MSME Banking

We differentiate ourselves through the extensive business support programme we offer, the superior customer experience we deliver and the advanced data analytics capabilities we have.

FY 2023 highlights

-

68% of newly registered legal entities chose TBC Bank4

-

c. 62,400 monthly active customers

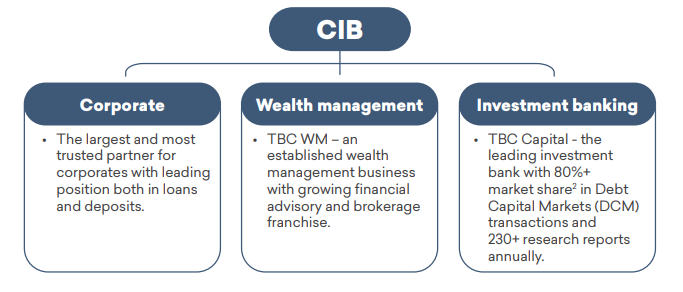

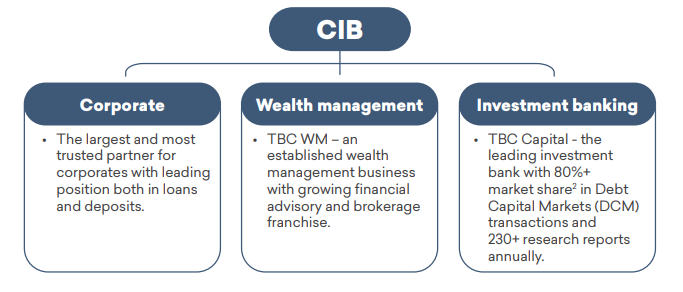

Corporate and Investment Banking

Our success is driven by our client-centric business model, our investment in talent and our focus on advancing data analytics and digital capabilities.

FY 2023 highlights

-

40.7% CIB loan market share1

-

44.9% CIB deposit market share1

-

c. 7,500 customers

1 Market shares are Based on data published by National Bank of Georgia on analytical tool Tableau. In this context retail refers to individual customers and CIB refers to legal entities

2 The Net Promoter Score (NPS) was measured based on the survey conducted by the independent research company IPM in December 2022

3 Includes collateralised business and agri loans up to GEL 1 million, as well as micro businesses with a maximum turnover of GEL 2 million

4 Based on data shared by National Statistics Office of Georgia