TBC Bank Group PLC (the "Company" and, together with its subsidiaries, the "Group") is committed to the highest standards of corporate governance which are in accordance with UK and international best practice.

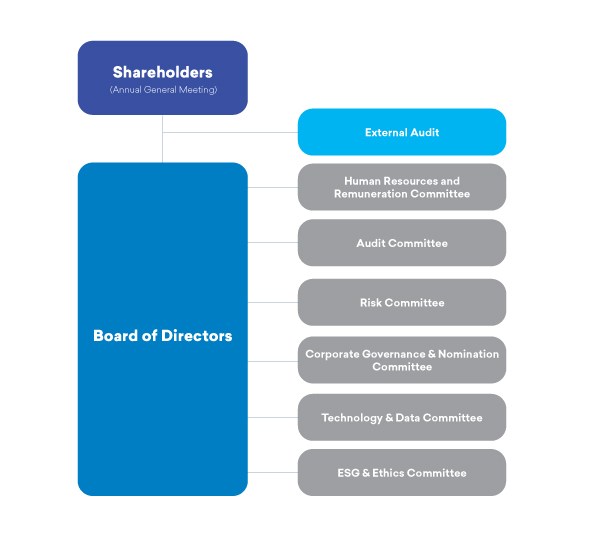

The Company's main corporate governance body is the Board of Directors (the "Board"), as directed by the General Meeting of Shareholders. In addition, appropriate committees have been established at the Board Level.

The Group's governance structure establishes a proper framework for the Board to pursue objectives that are in the interest of the Group, and effectively manage the relationship between the Directors and shareholders.

The Group has a comprehensive range of policies and systems in place to ensure that the Group is well-managed, with effective oversight and control.

Board of Directors

Board of Directors has ultimate responsibility for the Bank's business, risk strategy and financial soundness, and how it organizes and governs itself.

- Responsibility for the overall management of the Group and oversight of the Group’s operations;

- Approval of the Group’s long-term objectives and commercial and investment strategy;

- Approval of the annual operating and capital expenditure budgets and any material changes to them;

- Monitoring of the performance in light of the Group’s strategy, objectives, business plans and budgets;

- Extension into new business and geographic areas;

- Any decision to cease the Group’s operations.

Division of Responsibilities

Matters Reserved for the Board

Committees

These Committees exist to strengthen the Bank's structure and management processes. (Read More)

Articles of Associations

View our Articles of Association PDF (0.5 MB)

UK Corporate Governance Code

UK Corporate Governance Code (formerly the Combined Code) sets standards of good practice in relation to board leadership and effectiveness, remuneration, accountability and relations with shareholders. (Read More)